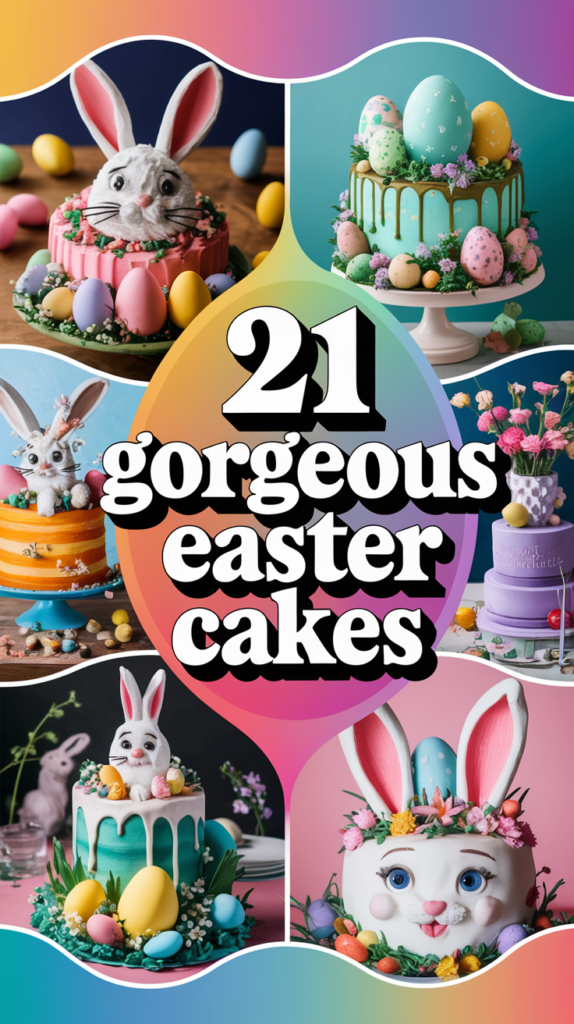

21 Gorgeous Easter Cakes You’ll Want to Bake This Spring!

21 Gorgeous Easter Cakes You’ll Want to Bake This Spring!

Spring has arrived, and with it comes the vibrant celebration of Easter, a time filled with joy, renewal, and delightful treats.

This year, why not elevate your Easter festivities with a stunning cake that captures the essence of the season?

From pastel colors to floral decorations, these 21 gorgeous Easter cakes are sure to inspire your baking adventures. Get ready to impress your family and friends with these delicious creations that not only taste divine but also look like works of art!

1. Lavender Lemon Cake

This refreshing Lavender Lemon Cake combines the zesty flavor of lemons with the delicate floral notes of lavender.

The cake layers are infused with fresh lemon juice and zest, creating a bright, tangy flavor, while the lavender adds an aromatic touch. Topped with a creamy lemon buttercream and garnished with edible lavender flowers, this cake is perfect for spring gatherings.

To bake this cake, you’ll need flour, sugar, butter, eggs, milk, baking powder, lemon juice, lemon zest, and dried edible lavender. Bake the layers, let them cool, and then assemble with buttercream layers in between. This cake is a showstopper that tastes as good as it looks!

2. Carrot Cake with Cream Cheese Frosting

No Easter celebration is complete without a classic Carrot Cake, and this version is truly irresistible.

Moist and flavorful, this cake is packed with grated carrots, crushed pineapple, and a hint of cinnamon. The creamy cream cheese frosting adds the perfect touch of sweetness to balance the spices. Decorate it with chopped walnuts and a sprinkle of shredded coconut for an Easter twist.

For this recipe, gather all-purpose flour, sugar, baking soda, baking powder, cinnamon, grated carrots, crushed pineapple, and eggs. Bake the cake until golden, let it cool, frost generously, and enjoy a slice of this delightful treat.

3. Chocolate Bunny Cake

This fun and whimsical Chocolate Bunny Cake is sure to be a hit with kids and adults alike!

Made with rich chocolate layers, this cake is filled with chocolate ganache and covered in a fluffy chocolate frosting. The cake is shaped like a bunny and decorated with fondant ears, eyes, and a sweet little nose. For an extra touch of fun, sprinkle colorful candy confetti around the base.

To create this cake, you’ll need cocoa powder, flour, sugar, eggs, butter, and heavy cream for the ganache. Bake the layers, shape them into a bunny, and let your creativity shine with the decorations!

4. Strawberry Shortcake

Celebrate Easter with a delightful Strawberry Shortcake that showcases the best of spring’s fresh produce.

Layers of light, fluffy sponge cake are filled with sweetened whipped cream and juicy strawberries, making each bite a heavenly experience. Top it off with a generous dollop of whipped cream and more strawberries for a stunning presentation.

For this recipe, use cake flour, sugar, baking powder, eggs, heavy cream, and fresh strawberries. Bake the sponge cakes, cool them down, and create beautiful layers filled with the sweet and luscious fruit.

💥🎁 Christmas & Year-End Deals On Amazon !

Don't miss out on the best discounts and top-rated products available right now!

🛒 Shop Now and Save Big Today!*As an Amazon Associate, I earn from qualifying purchases.

5. Coconut Cream Cake

Transport your taste buds to a tropical paradise with a Coconut Cream Cake that embodies the essence of spring.

This moist cake is infused with coconut milk and topped with a luscious coconut cream frosting. Finish it off with toasted coconut flakes for added texture and flavor. It’s a perfect addition to your Easter dessert table, offering a unique twist on traditional cakes.

Gather your ingredients: all-purpose flour, sugar, baking powder, coconut milk, eggs, and shredded coconut. Bake the cake layers, let them cool, and generously frost with the creamy coconut frosting for a delicious treat.

6. Raspberry Almond Cake

Brighten up your Easter celebrations with a Raspberry Almond Cake that combines sweet and tart flavors beautifully.

The almond-flavored cake layers are filled with raspberry jam, creating a delightful contrast, while the almond buttercream frosting adds a creamy richness. Decorate with fresh raspberries and almond slivers for a sophisticated finish.

For this recipe, use almond flour, sugar, eggs, butter, and raspberry jam. Bake the layers, assemble with jam in between, and frost generously for a show-stopping dessert.

7. Hot Cross Bun Cake

Bring the traditional flavors of Easter into a delightful Hot Cross Bun Cake that pays homage to this classic treat.

This spiced cake is filled with raisins and citrus zest, mimicking the beloved hot cross buns. Topped with a sweet glaze and a cross made from icing, it’s a unique twist that will impress your guests.

Gather ingredients like flour, sugar, spices, dried fruit, and eggs. Bake the cake, let it cool, and decorate with a sweet icing cross for a charming finish.

8. Floral Garden Cake

Celebrate the beauty of spring with a Floral Garden Cake that is as beautiful as it is delicious.

This cake features layers of vanilla sponge filled with smooth buttercream and is adorned with an array of colorful edible flowers. It’s a perfect centerpiece for your Easter table, showcasing the season’s vibrant colors.

To create this masterpiece, gather flour, sugar, butter, eggs, and your choice of edible flowers. Bake the layers, frost generously, and let your creativity shine with flower placements for a stunning result.

9. Pistachio Cake with Rosewater Frosting

Indulge in a Pistachio Cake with Rosewater Frosting that brings a touch of elegance to your Easter celebrations.

This moist cake, infused with crushed pistachios, is complemented by a light and fragrant rosewater frosting. Decorate with crushed pistachios and edible rose petals for a stunning finish.

Use ingredients such as pistachio flour, sugar, eggs, butter, and rosewater to create this unique dessert. Bake the cake, let it cool, and frost it beautifully for a captivating presentation.

10. Blueberry Lemon Bundt Cake

This Blueberry Lemon Bundt Cake is bursting with flavor and perfect for springtime gatherings.

Moist and tangy, this cake incorporates fresh blueberries and zesty lemon, making it a delightful treat for your taste buds. Drizzle with a lemon glaze for added sweetness and visual appeal.

For this recipe, gather flour, sugar, baking powder, blueberries, lemon zest, and eggs. Bake in a bundt pan for a gorgeous shape, let it cool, and drizzle with glaze for a deliciously beautiful cake.

💥🎁 Christmas & Year-End Deals On Amazon !

Don't miss out on the best discounts and top-rated products available right now!

🛒 Shop Now and Save Big Today!*As an Amazon Associate, I earn from qualifying purchases.

11. Chocolate Chip Cookie Cake

Combine the best of both worlds with a Chocolate Chip Cookie Cake that’s sure to satisfy any sweet tooth.

This giant cookie cake is soft, chewy, and packed with chocolate chips, making it a crowd-pleaser. Top it with a layer of chocolate frosting and colorful sprinkles for a fun and festive look.

For this recipe, use flour, brown sugar, butter, eggs, and plenty of chocolate chips. Bake in a round cake pan, let it cool, and frost it generously for a delightful dessert.

12. Confetti Cake

Bright and cheerful, a Confetti Cake is a perfect way to celebrate Easter with a splash of color.

This vanilla cake is studded with colorful sprinkles, making it a festive treat for all ages. Frost it with a rich buttercream and top it with additional sprinkles for an eye-catching finish.

Gather your ingredients: flour, sugar, butter, eggs, and rainbow sprinkles. Bake your cake layers, frost them generously, and watch the smiles appear as you serve this delightful dessert.

13. Peanut Butter Chocolate Cake

Indulge in a decadent Peanut Butter Chocolate Cake that will satisfy your sweet cravings this Easter.

This rich chocolate cake is layered with creamy peanut butter frosting, creating a deliciously addictive combination. Top it with chocolate ganache and chopped peanuts for an irresistible finish.

For this recipe, gather flour, cocoa powder, sugar, butter, eggs, and peanut butter. Bake your chocolate layers, allow them to cool, and assemble them with layers of peanut butter frosting for a divine dessert.

14. Matcha Green Tea Cake

Celebrate the beauty of spring with a Matcha Green Tea Cake that’s both stunning and flavorful.

This light and airy cake is infused with matcha green tea, offering a unique twist while adding a beautiful green hue. Top it with a light cream cheese frosting and a sprinkle of matcha powder for a sophisticated touch.

Gather ingredients like flour, sugar, eggs, butter, and matcha powder to create this elegant dessert. Bake the layers, frost them, and enjoy the delightful taste and stunning appearance.

15. Orange Olive Oil Cake

Delight your taste buds with an Orange Olive Oil Cake that’s moist and bursting with citrus flavor.

This cake uses olive oil instead of butter, resulting in a tender crumb and a unique flavor profile. Topped with a sweet orange glaze, it’s a refreshing dessert for your Easter table.

For this recipe, gather flour, sugar, eggs, olive oil, and fresh orange juice. Bake the cake until golden, let it cool, and drizzle with the sweet glaze for a beautiful presentation.

16. Tiramisu Cake

Bring a touch of Italian flavor to your Easter dessert table with a delightful Tiramisu Cake.

This cake features layers of coffee-soaked sponge and rich mascarpone cream, creating a luscious and indulgent treat. Dust with cocoa powder for a classic finish that everyone will love.

Gather ingredients such as ladyfingers, coffee, mascarpone cheese, cocoa powder, and sugar. Assemble the layers, chill them, and serve for a heavenly dessert experience.

💥🎁 Christmas & Year-End Deals On Amazon !

Don't miss out on the best discounts and top-rated products available right now!

🛒 Shop Now and Save Big Today!*As an Amazon Associate, I earn from qualifying purchases.

17. Nutella Swirl Cake

Indulge in a Nutella Swirl Cake that brings a rich, chocolatey flavor to your Easter celebrations.

This cake is made with a moist vanilla base, swirled with generous ribbons of Nutella throughout. Top it with a light chocolate ganache for a truly decadent dessert.

For this recipe, gather flour, sugar, eggs, butter, and of course, Nutella. Bake the layers, swirl in the Nutella, and frost for a deliciously beautiful cake.

18. Cherry Almond Cake

Celebrate Easter with a delightful Cherry Almond Cake that combines sweet and nutty flavors.

This moist almond cake is studded with fresh cherries and topped with a light almond frosting, making it a perfect spring treat. Garnish with sliced almonds and cherries for a beautiful finish.

Gather ingredients like almond flour, sugar, eggs, and fresh cherries. Bake the cake, frost it, and watch as it becomes a favorite at your Easter gathering!

19. S’mores Cake

Bring the campfire to your Easter table with a delicious S’mores Cake that captures the essence of outdoor fun.

This cake is made with layers of chocolate cake, graham cracker crumbs, and marshmallow frosting, topped with a gooey chocolate ganache. It’s a delightful treat that will have everyone reminiscing about summer nights.

For this recipe, use flour, cocoa powder, sugar, and graham cracker crumbs. Bake the layers, assemble them with frosting, and toast marshmallows for a fun finish.

20. Mint Chocolate Cake

Refresh your Easter dessert table with a Mint Chocolate Cake that combines rich chocolate with a cool mint flavor.

This cake features layers of moist chocolate cake paired with mint buttercream frosting, creating a delightful harmony of flavors. Decorate with chocolate shavings and mint leaves for a beautiful touch.

Gather ingredients such as cocoa powder, flour, sugar, eggs, and peppermint extract. Bake the layers, frost with mint buttercream, and enjoy a refreshing dessert.

21. Lemon Meringue Cake

End your Easter celebration on a high note with a stunning Lemon Meringue Cake that dazzles the senses.

This cake features layers of zesty lemon cake, filled with tangy lemon curd and topped with a fluffy meringue that’s beautifully toasted for a delightful contrast. It’s a showstopper that will leave everyone wanting more.

For this recipe, gather flour, sugar, eggs, lemon juice, and meringue ingredients. Bake the layers, fill with lemon curd, and top with a beautifully toasted meringue for a breathtaking presentation.

Conclusion

With these 21 gorgeous Easter cakes, you have a delightful array of options to celebrate this spring season.

From classic flavors to innovative creations, each cake offers a unique way to bring joy to your Easter festivities. So gather your ingredients, unleash your creativity, and make this year’s Easter celebrations truly unforgettable!

💥🎁 Christmas & Year-End Deals On Amazon !

Don't miss out on the best discounts and top-rated products available right now!

🛒 Shop Now and Save Big Today!*As an Amazon Associate, I earn from qualifying purchases.